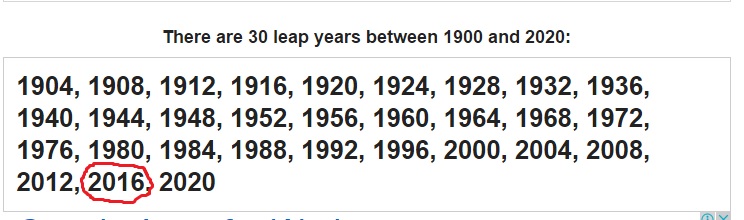

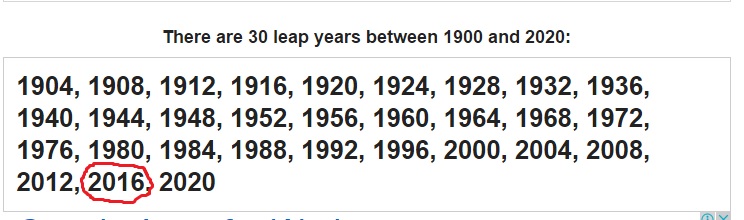

JSTOR ( February 2020) ( Learn how and when to remove this template message)Ī leap year (also known as an intercalary year or bissextile year) is a calendar year that contains an additional day (or, in the case of a lunisolar calendar, a month) added to keep the calendar year synchronized with the astronomical year or seasonal year.Unsourced material may be challenged and removed. Please help improve this article by adding citations to reliable sources. To minimize errors, make sure your payroll system is configured to account for leap years.This article needs additional citations for verification. Also, consider the impact of the extra payday on paycheck deductions, such as payroll taxes and voluntary benefits. Whichever option you choose, be sure to inform your employees up front so they know what to expect. Reduce employees’ last paycheck of the year.This will slightly decrease employees’ paychecks, but it should even out to their normal salary at the end of the year. For biweekly pay periods, divide the annual salary by 27 instead of 26. For weekly pay periods, divide the annual salary by 53 instead of 52.

Prorate salaries based on the number of pay periods. This will result in employees receiving more money because they are literally receiving an extra paycheck at the same salary. You can handle the extra pay period in one of three ways: Because 2020 has an extra Thursday, they will get 27 paychecks for 2020. So, if your salaried employees are paid weekly or biweekly on a Wednesday or Thursday, they might get an extra paycheck.įor example, salaried employees who get paid biweekly on every other Thursday typically receive 26 paychecks per year. The 2020 leap year has 53 Wednesdays and 53 Thursdays. What does the 2020 leap year mean for payroll? Further, hourly employees are paid according to time worked, not based on the number of days in the year. Why aren’t employees who are paid hourly, semimonthly or monthly impacted by leap years?Īnnually, semimonthly paid employees receive 24 paychecks and monthly paid employees receive 12 paychecks, no matter how many days are in the year. So, a leap year has two extra days, increasing the likelihood of an additional payday for salaried employees who are paid weekly or biweekly. However, a leap year has 366 days - due to February having 29 days instead of 28 - in which five days of the week happen 52 times and two days happen 53 times. Here’s the bottom line: A nonleap year has 365 days, in which six days of the week happen 52 times and one day happens 53 times. Therefore, the potential for an extra payday is present in both nonleap and leap years. Over time, those extra fractions add up, resulting in 53 paydays for weekly paid employees and 27 paydays for biweekly paid employees. But if you do the math, you’ll see some unaccounted overage: Normally, a calendar year has 365 days, over which weekly paid employees receive 52 paychecks per year and biweekly paid employees get 26 paychecks per year. How does a leap year affect salaried weekly or biweekly paid employees?

Prorate salaries based on the number of pay periods. This will result in employees receiving more money because they are literally receiving an extra paycheck at the same salary. You can handle the extra pay period in one of three ways: Because 2020 has an extra Thursday, they will get 27 paychecks for 2020. So, if your salaried employees are paid weekly or biweekly on a Wednesday or Thursday, they might get an extra paycheck.įor example, salaried employees who get paid biweekly on every other Thursday typically receive 26 paychecks per year. The 2020 leap year has 53 Wednesdays and 53 Thursdays. What does the 2020 leap year mean for payroll? Further, hourly employees are paid according to time worked, not based on the number of days in the year. Why aren’t employees who are paid hourly, semimonthly or monthly impacted by leap years?Īnnually, semimonthly paid employees receive 24 paychecks and monthly paid employees receive 12 paychecks, no matter how many days are in the year. So, a leap year has two extra days, increasing the likelihood of an additional payday for salaried employees who are paid weekly or biweekly. However, a leap year has 366 days - due to February having 29 days instead of 28 - in which five days of the week happen 52 times and two days happen 53 times. Here’s the bottom line: A nonleap year has 365 days, in which six days of the week happen 52 times and one day happens 53 times. Therefore, the potential for an extra payday is present in both nonleap and leap years. Over time, those extra fractions add up, resulting in 53 paydays for weekly paid employees and 27 paydays for biweekly paid employees. But if you do the math, you’ll see some unaccounted overage: Normally, a calendar year has 365 days, over which weekly paid employees receive 52 paychecks per year and biweekly paid employees get 26 paychecks per year. How does a leap year affect salaried weekly or biweekly paid employees?

Leap years have no effect on hourly paid employees or salaried employees who are paid semimonthly or monthly. Note that leap years impact only salaried employees who are paid weekly or biweekly. With 2020 being a leap year, you should know whether your payroll will be affected. How the 2020 Leap Year Could Affect Your PayrollĪ leap year occurs every four years, and for some employees it means an additional payday.

0 kommentar(er)

0 kommentar(er)